Society of Actuaries: ACA Impact Will Vary gSubstantially Across State Linesh

July 17, 2013 - AHIP

The New

York Times has a front-page story this morning examining the impact of

the Affordable Care Act (ACA) on individual market premiums in New York.

The article states that, gState insurance regulators say they have approved

rates for 2014 that are at least 50 percent lower on average than those

currently available in New York.h

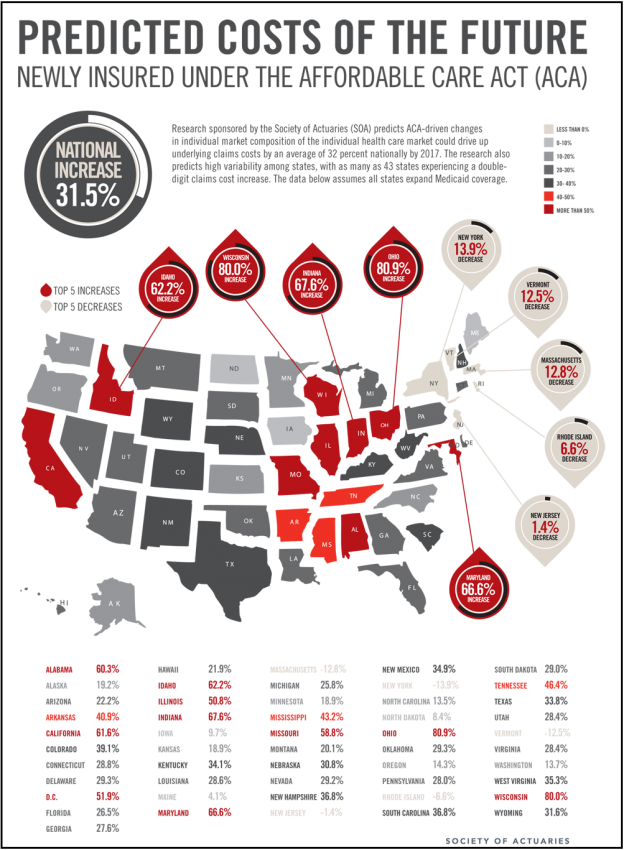

When examining the impact of the ACA on premiums, it is important to note the

wide variation in impact that is likely to occur across states. As a

previous Society of Actuaries (SOA) study

found, consumers can expect the gaverage change in individual market costs

varying substantially across state lines.h

According to the SOA report, gthe significant state-by-state variation can be

attributed to many factors, including whether or not the state sponsored a

high-risk pool, differences in current underwriting practices, and demographic

characteristic and income level differences in state populations. In simplest

terms, the states that will see large increases generally have low current

individual costs and those showing decreases have high current individual costs,

with all states moving closer together but at a higher level overall.h

As many of you know, New York was one of eight states that enacted insurance

market reforms in the 1990s without requiring everyone to purchase

coverage. As the Times story notes, these reforms caused

significant disruption in the statefs individual insurance market:

gFor years, New York has represented much that can go wrong with insurance

markets. The state required insurers to cover everyone regardless of

pre-existing conditions, but did not require everyone to purchase insurance — a

feature of the new health care law — and did not offer generous subsidies so

people could afford coverage. With no ability to persuade the young and the

healthy to buy policies, the statefs premiums have long been among the

highest in the nation. eIf there was any state that the A.C.A. could bring rates

down, it was New York,f said Timothy Jost, a law professor at Washington and Lee

University who closely follows the federal law.h

The article adds that gBecause the cost of individual coverage has soared,

only 17,000 New Yorkers currently buy insurance on their own. About 2.6 million

are uninsured in New York.h

Given that New York previously enacted many of the insurance market reforms

required by the ACA, the impact on premiums in that state will be much different

than in the vast majority of states that do not currently have those reforms in

place.

To learn more about the impact of the ACA on premiums, visit http://www.timeforaffordability.org/.

© 2013,

AHIP Coverage 601 Pennsylvania Avenue, Suite 500,

Washington, DC 20004